Let's be honest: we freelancers like to think of ourselves as a pretty intelligent lot. And yet, when it comes to managing our tax affairs, we can suddenly feel rather stupid.

But we're here to reassure you. No, you're not stupid. And you're not alone in struggling with tax either.

A staggering 73% of freelancers say that tax management is the biggest strain on their mental health. And that's not at all surprising. In truth, the UK's tax system is old-fashioned, overly convoluted, confusing and very user-unfriendly. More than a third of Brits (36%) say it's the one topic in life they understand the least.

If only there was an easy-to-use app that could guide you through the process from start to finish, with humans on hand to give advice when you get stuck. Well, now there is!

Pie: the app to solve your tax problems

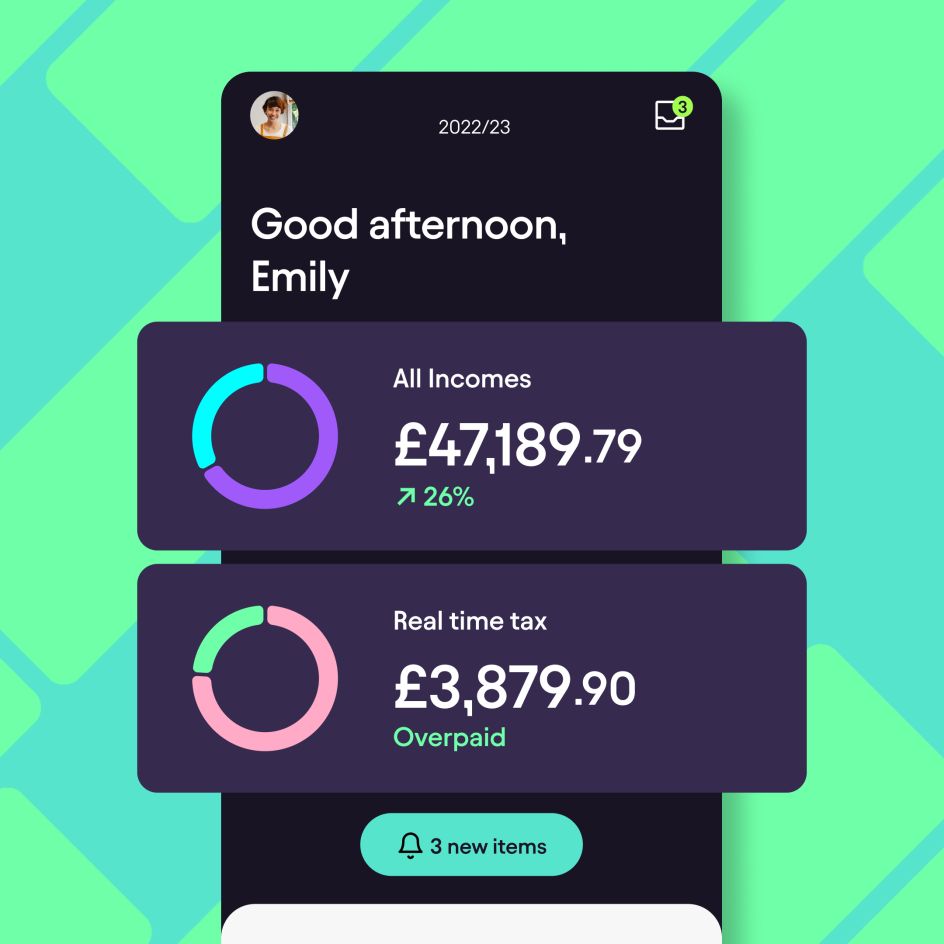

Pie is quite simply the app freelancers have been crying out for. And that's because it's the UK's first-ever digital solution for managing your entire tax process, from start to finish.

With an attractive and super-intuitive interface, Pie makes it a cinch to manage your invoicing, bookkeeping and tax affairs – all in one place. It's a bit like having an accountant in your pocket, available to you 24/7, wherever you are.

So rather than constantly stressing about how much tax you owe, what happened to that electronic receipt, when that client invoice was settled, and a million other things you'd rather not be thinking about – you don't have to.

Instead, Pie keeps everything managed and organised, from invoicing your clients to filing your tax returns with HMRC. You can view your tax bill, projections and income in one place whenever you need. And that frees up huge amounts of time for you to focus on earning money rather than stressing over tedious and stressful admin.

It even looks great, thanks to a brilliant visual identity designed by one of our favourite agencies, Output!

Perhaps most importantly, there'll be no unpleasant tax surprises at the end of the year because Pie keeps track of how much tax you'll owe on a real-time basis. And at a time when prices and rents are rising, client budgets are tightened, and freelancers are being squeezed from all directions, that's not to be sneezed at.

Let's delve into some of Pie's key functions...

1. Integrated invoicing

Pie goes beyond tax management by enabling you to conduct all the diverse elements of your freelancer affairs in one handy interface. That means, for example, that you can create and send digital invoices, track payments, and manage your income, all within the app.

Automatic payment reminders save you time and make it more likely that clients will pay promptly, while revenue tracking helps you keep an eye on how much you've got going out and coming in. How cool is that?

2. Stress-free bookkeeping

Let's face it: you don't work in a creative discipline like design, illustration, photography or animation because you like boring, tedious bureaucracy. Instead, you want to spend as much time creating cool stuff as possible, and so dull tasks like bookkeeping tend to get kicked into the background.

"I'll get that sorted when I've got a quiet day," you tell yourself. But that day never seems to come; the scale of the task just keeps mounting up, and you become increasingly unwilling to tackle it.

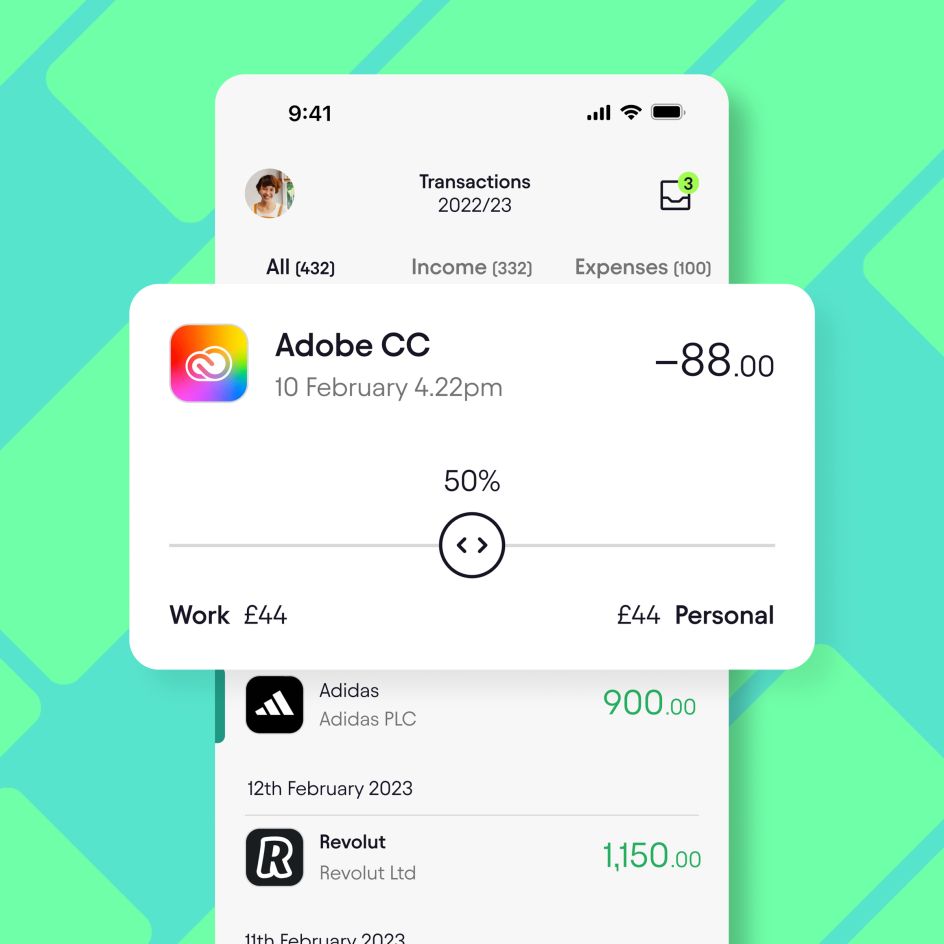

Pie is here to change that by taking most of the grunt work off your hands. For instance, the app effortlessly imports and categorises your bank transactions to identify eligible expenses for refunds. It also stores all your expense receipts, ensuring compliance in case of HMRC audits.

All this makes bookkeeping much easier, as well as helping you to keep track of what you're spending and expediting the tax return process overall.

3. Organising multiple sources

Juggling multiple income sources can be a real issue if you're a creative freelancer with many strings to your bow and/or other income, such as property and share earnings. In these scenarios, Pie's ability to consolidate income and outgoings from various accounts is a real game-changer.

Whether it's investments or diverse freelance gigs, Pie automatically highlights expenses eligible for refunds, providing clarity when – if left to your own devices – you'll probably end up hopelessly confused. That alone makes Pie a must-have for any multidisciplinary creative or any freelancer who hopes to be one in the future.

4. Seamless HMRC submission

In the UK, a staggering 600,000 people received a £100 fine for late submission of their tax return last year. And even if you weren't one of them, there's a good chance you might be in the future. Because with the best will in the world, life gets in the way, and most of us end up scrambling to submit in the last couple of days before the deadline.

Then, inevitably, the system crashes, and you spend the best part of a day trying to log in. So even if you manage to submit before the deadline and escape the fine, that's time you could have used to create stuff and earn freelance income... so it's really just another kind of financial penalty.

With Pie, though, you'll never have this problem. Because Pie isn't just a tool; it's a registered tax agent. This means that all aspects of the tax return process can be executed within the app, with submissions sent directly to HMRC.

Therefore, missing deadlines due to confusion or procrastination will become a thing of the past. And through Pie's live return tracker, you can monitor the progress of your tax returns every step of the way. This transparent view offers a sense of control and visibility that's long been absent from the tax journey.

5. Real-time tax insights

Unlike traditional approaches to accounting, which essentially leave freelancers in suspense for up to 20 months, Pie keeps you updated with your live tax position 24 hours a day, 365 days a year. This means you'll be able to easily check the tax amount you owe at any given time, along with up-to-date income, outgoings, deductions, and credits.

With the recent Making Tax Digital initiative making quarterly income reporting a requirement, this facility is more useful and important than ever.

6. Live tax support

Of course, however good an app is, sometimes there's no substitute for talking to a real-life human expert. So it's great news that Pie supplies that through a live support service staffed by assistants who can guide you through the tax process at your own speed.

These experts are sector-specific, with years of knowledge and experience, which means that whatever your speciality, you'll get tailored advice that makes sense. This personalised assistance is available around the clock, making those frantic last-minute calls to HMRC in the days leading up to the submission deadline a thing of the past.

Get started with Pie today!

So what are you waiting for? With higher living costs tugging at our day-to-day finances, it's never before been more important to stay up to date with all aspects of your personal finance and tax management.

Pie makes this super simple, freeing up your time to earn more money on productive work and helping you keep up to date with bills, rent and more. Get started today by visiting the Pie website.

](https://www.creativeboom.com/upload/articles/86/862919952c0ad18439004228895a431dc6e45ffc_732.jpg)