Tax requirements can be complex and change regularly. So, check this year’s most recent tax changes if you are a sole proprietor, independent contractor, or running a partnership business. Most tax laws created during the COVID-19 pandemic are set to expire this year.

Here are the most important facts if you want to file taxes this year:

A business owner needs to be current on tax legislation. Several changes to the federal tax code may affect small businesses this tax year. Read this guide to learn the most important facts about filing taxes this year.

Changed credit for pension plan start-up fees:

The SECURE Act expands the Section 45E deduction. It is for the first five employer tax years beginning in 2023. It applies to all or a part of employer contributions to small employer pensions—the employer contribution credit limits to $1,000 per employee. Firms with 50 or fewer employees are eligible for the full credit, which is gradually phased out for firms with more than 100 employees.

Network operations rules:

This year, the rules for claiming a net operating loss are changing. You have an operating loss when your deductions exceed your gross income. In general, you can carry the loss forward to make up for revenue in later years. You can only deduct up to 80% of your taxable income. A net operating loss incurred in 2018, 2019, or 2020 that you carry forward is not subject to the 80%-of-taxable-income limit. The 80-percent-of-taxable-income limitations reapply to net operating losses generated after 2020.

Exceeding the business-loss limitation rules:

Businesses might carry net operating losses back five years or forward forever. Thanks to a temporary suspension of Tax Cuts and Jobs Act provisions in 2019 and 2020. The suspension has expired. Losses of more than $540,000 annually for married filers filing jointly or $270,000 for single filers are not deductible. However, this applies to all business income and losses. It includes Schedule C. It even includes income and losses from pass-through businesses. You can carry the above mentioned losses to reduce your taxable income in future years. Furthermore, W-2 wages cannot cover business losses. Spousal income is also taxed separately and may result in a tax bill even if business losses exceed the spousal income.

Important 2023 deadlines

Keep the following tax deadlines in mind for 2023:

- For sole proprietorships, household employers, and C corporations, 2022 tax returns are due by midnight on April 18, 2023. Taxes for S companies and partnerships are due on March 15, 2023.

- The expected income tax dates for 2023 are April 18 for Q1, June 15 for Q2, September 15 for Q3, and January 15, 2024, for Q4.

- Tax reports and payments for 2023 are due on April 18, 2024. By March 15, 2024, S companies and partnerships must file.

Note: It’s essential to keep track of all employee’s paystubs as it will help to file tax deductions during tax year 2023.

Rule of interest expense limitation:

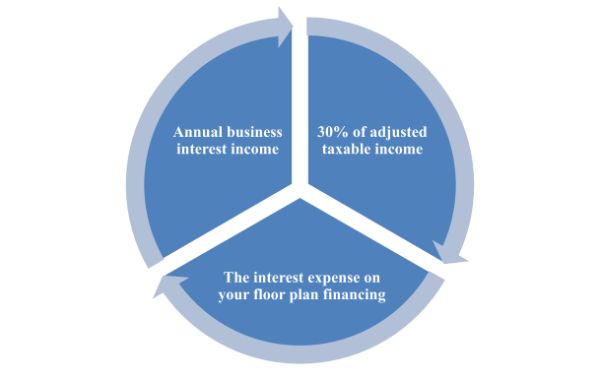

It limits the total amount of deductible interest expenditure for the year to the total of the following:

This tax rule was not applicable during the pandemic, but it will be active in 2022 and beyond.

Charitable contributions increased limits ended:

For the 2023 tax year, the charitable contribution provision is no longer in effect. This permitted C corporations and individuals to deduct a higher percentage of their income.

Deferred use of new 1099-k form:

According to the American Rescue Plan Act of 2021, small business owners and independent contractors receiving more than $600 from third-party digital platforms will get Form 1099-K declaring revenue beginning in the tax year 2022. Platforms like Amazon, Etsy, and eBay were also obliged to report this income to the IRS. This rule has been used for only a year due to opposition from taxpayers and companies. If it applies to your company, expect to receive a Form 1099-K in 2024 for the tax year 2023.

Cap on state and local taxes (salt):

Since 2020, filers have only been able to deduct up to $10,000 in state and local property and income taxes. The deduction is the same for solo filers and married couples filing jointly. SALT laws limit the deductions of many business owners who operate a pass-through organization in a high-tax state.

Tax benefits for pass-through businesses and corporations:

The tax reform legislation included a large deduction for pass-through and corporate companies. Small businesses established as S corporations, sole proprietorships, and partnerships are pass-through entities. Pass-throughs account for approximately 95 percent of all enterprises in the United States. The law now allows those enterprises to deduct 20% of their profits. The deduction will phase out in 2022 at taxable income levels between $170,050 and $220,050, and the thresholds are changing for inflation in 2023. This deduction will start phasing out beginning in 2027. C corporations also received a significant tax break: The Jobs Act reduced the corporation tax rate from 35% to 21%.

BONUS DEPRECIATION COMES TO AN END:

Many small business owners relied on depreciation to help reduce the cost of necessary equipment. Yet, the option for bonus depreciation (claiming 100 percent in the year you buy the equipment) will be phased away in 2023. Bonus depreciation will reduce by 20% each year until it is no longer available in the following tax year. This indicates that investing in your company today is critical, while bonus depreciation is still accessible. Many small business owners, particularly self-employed ones, refrain from making large renovations. After all, they fear they won’t be able to pay for it or trying to decide whether to get a business-only credit card because they’re uncertain whether business credit cards damage your credit. Taking advantage of what is currently available is in your best interest. It will become more difficult to get government help in the form of tax deductions that you can use to build your business.

Many more businesses can use the FFCRA and ERC:

The Families First Coronavirus Response Act (FFCRA) and the Employee Retention Credit (ERC) are tax breaks given to bigger firms. It was to help offset the economic damage caused by COVID-19. The Biden Administration has now opened routes for freelancers, gig workers, and small businesses. Thanks to revisions in the CARES Act, they can now access government COVID relief in the form of tax credits for their 2020 and 2021 taxes.

New credit for green business ideas:

The Energy-Efficient Commercial Buildings Deduction. It allows business owners to claim a tax credit for each square foot of renovation for approved eco-friendly upgrades. It is an expansion under the Inflation Reduction Act. Furthermore, a tax credit of up to $7,500 is now available for electric or fuel cell electric vehicles utilized for business purposes. If your company ships a lot of freight and requires its professional transporters, the tax credit is $40,000.

The bottom line

These are a handful of the major changes that will affect small businesses in the financial year 2023. Consult with your CPA to determine your qualifications for these new opportunities. Ensure your company receives all the government help.